Net worth is a way for you to see the financial profit of a business that is you. If you are running a business one of the first things you need to understand is how much is coming in and how much money is going out. Now, imagine you want to hold on to some of the profits, then use that money to start investing. That is, buying something that will retain its value, and has the potential to return a little extra. As a result, you can start building wealth and that wealth is your net worth.

How to understand net worth

Net worth is calculated by taking all your assets and weighing it against your liabilities, or simply take the total value of your assets and subtract the total value of your liabilities.

Assets – Liabilities = Net Worth

To calculate this equation we need to know the value of all assets and liabilities

What is the value of all your total assets?

An asset is a resource that is owned/controlled by you, which has a positive financial value. Imagine your life is a business, some things that hold positive financial value could include, cash, stocks, car, house, property etc. The idea is to list all things that hold positive, with possessions such as your car, computer etc. its best to underestimate as depreciation comes into play.

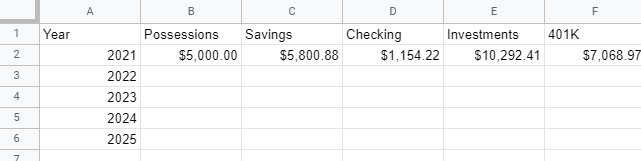

To keep things simple here are the categories I current use for my assets, possessions, savings accounts, checking accounts, total investments, and 401K. As a 25 year old professional these are all the categories I need for my assets. Possessions include things such my car, computer, furniture etc. Anything physical that holds value current, and I underestimate the value for these. Investments is another board category that holds many things inside, such as stocks, business ventures etc.

Once you have an idea of your assets, now we can get to work and begin our Google Sheet. How I have it laid, is I want to see my annual net worth year over year. That is take a snapshot of my net worth at the end of each year, so that I can track my progress each year. To do this we can begin with a column called year, and list rows for started with this year.

Then we can add the columns for each category to the right of the “year” column.

Next we fill in each column with the total values for that year. For my investments a majority of it comes from a brokerage account where I buy my stock. So I just take my closing balancing on Jan. 1st. With bank accounts just take your current balance on Jan. 1st. Remember, we are just looking for a snapshot on Jan. 1st for net worth. Here is mine.

What is the value of all your total liabilities?

A liability is something that is owned/controlled by someone other than yourself, which has a negative financial value. For example, a loan is a sum of money that you borrow and pay a fee (interest) to use. You do not technically own the money, it’s owned by someone else who lets you use it for a fee. So when you take out a loan on a house, the value of the mortgage is a liability because you do not own that money. You are borrowing it from a bank and paying interest plus principle every month until the full value is paid off.

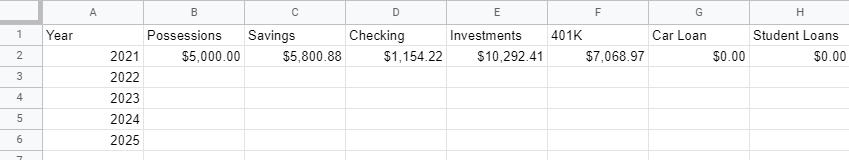

Liabilities can include, car loans, credit card debt, mortgages, etc. Liabilities vary from person to person, so you will need to make sure you are counting all of them correctly. When evaluating net worth, never underestimate your liabilities, it’s better to over estimate liabilities compared to underestimating your assets.

Once you have an exact idea of your liabilities, then we can start to list categories in the Google sheet right next to your assets. Then fill in the information, for each liability.

I do not currently have any financial liabilities, I actually just paid off my student loans at the end of 2020.

What is your net worth?

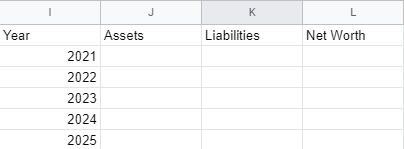

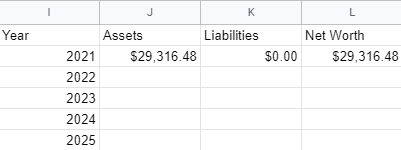

Now that we have our assets and liabilities we can create a new section for our net worth. Create three new columns with these names, Assets, Liabilities, Net Worth.

To fill these we will use a formula so that the sheet updates when we add new values, and makes things easier to track moving forward. Take the sum of all your assets, you can do this a couple ways. Here are the formulas for the example used.

=(sum(B2+C2+D2+E2+F2)) (Sum of the cells)

=(sum(B2:F2)) (Sum of the row, with column range B to F)

Then use the same formula for the liabilities.

=(sum(G2+H2))

=(sum(G2:H2))

Finally, we can add a formula for the net worth column. We are done!

=(J2-K2)

Yours’s should look something like this.

Completing this exercise is extremely valuable to see where you are at financially. I recommend completing this every year so that you can track your net worth and see the growth. Or if you are working hard to improve your financial situation, its important to see where you stand. If your net worth comes up negative that is OK, this my first year with a positive net worth. Since I began tracking in 2019 here is my progress.

Thanks for reading!

This is great content and nice trajectory from 2018 to 2020. Keep it up!

Incredible points. Outstanding arguments. Keep up the great work.