What does it take to actually be rich in our society nowadays? I can guarantee it is not some get some rich quick scheme promoted by finance gurus, or become a dogecoin millionaire. But rather it starts with something basic, something fundamental. That is knowing and understanding exactly how much money you spend. In this post, I will go through why tracking your expenses will make you rich.

How much do you make per a month

The first thing we need to understand is how much money you are actually making per month. That is, after taxes are paid what is your take home amount. Knowing this number is crucial for financial freedom, and the first step to knowing what your net income is.

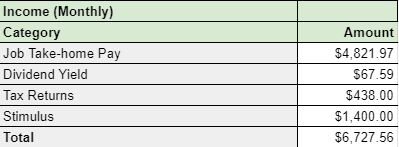

For example, in April 2021 I made $6,727.56. Here is a breakdown of that income:

Now that we know how much I made we can figure how much I spent (expenses) then we have taken the income minus the expenses to get our net return for the month.

How much do you spend per month

In a recent post, I explained how to track your monthly expenses using Chase banking data. The idea here is to be completely honest about how much you spend. I recommend to look at this objectively, and treat this as a would business. You are the CEO of your life, how do you see your spending? If a business was working to be profitable then why can’t we do the same with our finances.

Bravely venture into your monthly bank statements and add up every transaction. It is better to overestimate here than under estimate. The very act of looking at your expenses might be daunting at first but it’s a crucial first step to financial freedom. Because when you see the amount of money spent each month and where it goes. Then innately, the next month we will try harder to spend a little less.

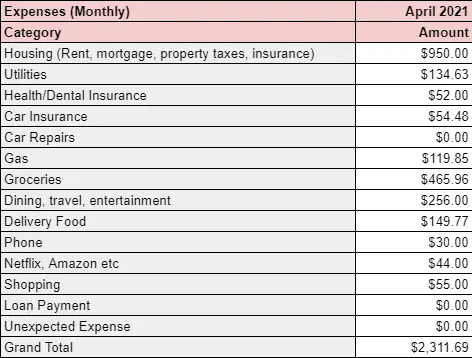

For example, in April 2021 I spent $2,311.69. Here is a breakdown of my expenses:

What is your net income after expenses

With knowing how much you made and much you spent we can now calculate net income. To do this we can take income minus expenses. In April 2021 I made $6,727.56 and spent $2,311.69, so my net income was $4,415.87! If your net income is not as much, or higher it doesn’t matter right now. The idea is that now we know and understand the relationship between income and expenses.

We can use this data to make actionable decisions today to help better our lives. Let’s assume that your net income was -$1,000 for the month. But now if there are ways to save a little extra each month to make this number better, whether to make extra or spend less. Then we should make those changes, so next month your net income could be -$900. Then work to find ways to improve again and again until you achieve a positive net income.

What to do when you have a positive net income

If you have achieved a positive income like I have, the work is not done yet but only just started. The idea is now to grow your net income (income minus expenses), and not just your total income. Because net income considers both increasing income, and decreasing spending. The goal is to lower expenses until you are living below your means. A comfortable net income is around the same amount of your expenses. So if you spend $2,000 a month, then make the goal to earn a net income of $2,000 per month or 50% your total income is not being spent.

We did something important here, we basically calculated a monthly return on investment (ROI) of your financial life. Think about all the work completed in that month, and ask yourself what was your return on that work. Well that was our net income as a percentage of total income. To find this out, take your net income and divide by total income.

For example, in April 2021 my net income was $4,415.87 and my total income was $6,727.56. Dividing net income by total income, I get 65.64% which is above my goal of 50%! April was a fantastic month, mostly due to stimulus and tax returns. But that 65.64% is my new highscore to beat, and each month I plan to beat that highscore.

From the last 5 months here is my progress at attempting to beat my highscore each month:

What to do with your actual net income

Once you have a stable positive net income the next thing to do is invest that net income. There are many things you can do to invest from starting a business, down payment on a house, investing in the stock market, or dollar cost averaging etc. But just taking a simple example of investing your net income each month in an index fund and getting an 8% annual return we can see how you can be rich later on in life.

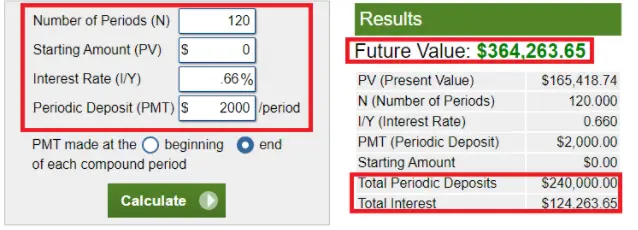

For example, my average net income is about $2,000 a month. Let’s say I invested that amount each month for 10 years into an index fund that returns 8% annually. How rich would I be? Thanks to the internet anyone can easily calculate this by using a future value calculator. Our numbers in my example are 10 years or 120 months (number of periods). Starting amount $0, interest rate per month is 0.66% or 8% per year, and our monthly investment is $2,000.

If I invested by $2,000 each month, I would have $364,263.65 at the end of 10 years, or $1,166,397.71 at the end of 20 years. All this started with tracking my expenses and growing my net income!

Summary

Starting with tracking monthly expenses, and sticking with a game plan we can see that anyone can be rich. Of course there is work to put in, but nothing is free in life and getting is difficult. A common pitfalls is thinking that tracking expenses is not cool, or there is no clout in it. I have seen this almost everyday while in my collage days. But thanks to compound interest, your is with more the younger you are. No one says you have to brag about doing the work and slowly become richer than your clout chasing friends. The silent wealth builder is still a wealth builder.

Another pitfall is increasing your lifestyle as you start to make more money in life. That is focus only on half of net income and working hard to increase your total income. But then throwing all that work away, but buying that nice car, going on vacations all the time etc. Don’t get me wrong all those things are great but let’s first reach financial freedom, before we live it. Instead, focus on net income after taking away your expenses. Then take the profits and invest in yourself either through investments, skills, etc.

Too many people live paycheck and forget that net income is actually more important than just income. Asking someone how much they make doesn’t say much, while asking someone how much they net each month tells a lot more!

Thanks for reading and hope the data of my life helps you start becoming rich!

I like what you guys are usually up too. This sort of clever work and coverage!

Keep up the wonderful works guys I’ve included you guys to

my own blogroll.

Whats up very cool site!! Man .. Beautiful .. Superb

.. I will bookmark your site and take the feeds additionally?

I am satisfied to seek out so many useful info here within the submit, we want

work out more techniques in this regard, thanks for sharing.

. . . . .

Hi there I am so grateful I found your site, I really found you

by error, while I was searching on Bing for something else, Anyways I

am here now and would just like to say kudos for a fantastic post and a

all round thrilling blog (I also love the theme/design), I

don’t have time to look over it all at the minute but I have saved it

and also included your RSS feeds, so when I have time I will be back to read much more, Please do keep up the

excellent job.

I was able to find good information from your blog articles.

Awesome blog! Is your theme custom made or did you download it from

somewhere? A theme like yours with a few simple adjustements would really make my blog stand

out. Please let me know where you got your theme. Cheers